Demand for top-dollar recreation listings will only go up as supply dwindles

Bill Morrison

Sun

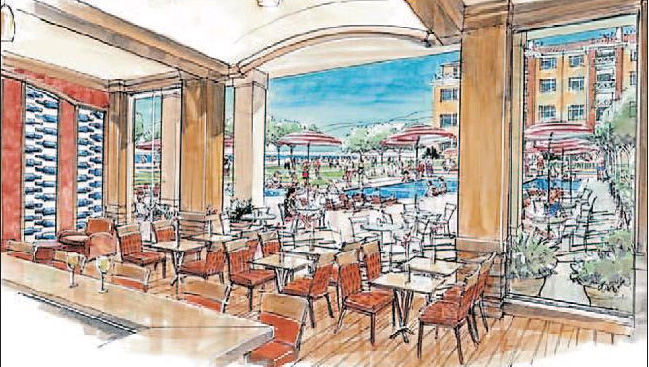

The homes in the Watermark Beach Resort, on Osoyoos Lake, were mostly bought in one day of selling

What happens when $41 trillion in demand meets a two-per-cent supply? What happens when the No. 1 objective of North America’s baby-boom generation is to own a second home?

What happens when investors begin to shift their attention away from traditional residential markets and focus instead on the virtually untapped “upside” of recreational real estate? The answers may astound you.

During the last few years, we’ve seen an incredible spike in demand for recreational property. This is only the beginning.

The cost of purchasing a recreational property is going to go up like nothing we have ever experienced before for one simple reason — never before in our history has more wealth been created or inherited.

According to the landmark Boston College study Millionaires and the Millennium, more than $41 trillion US will pass from parent to child between the last decade of the previous century and the middle decades of this, give or take a year or two.

As this money changes hands, it’s being delivered to the baby boomers at an older age. These boomers already lead a comfortable life with comfortable homes, cars and savings plans.

So, what will they do with the “found” money? They will buy recreational property and pay nearly any price for the good stuff.

The parents of these boomers used to be savers or purchasers of equities or savings bonds. The new generation would much rather “sit on their dock than sit on their stock!”

There are three reasons why people buy recreational real estate: lifestyle, capital appreciation and extra income via property rental. (Although this comes in a distant third.)

We know that A+ recreational real estate satisfies the need for lifestyle concerns and typically is located in areas of strong appreciation and liquidity. It also stands to reason then, that rental opportunities would be strong. This has put unprecedented pressure on waterfront, water view and select golf course property.

So, will all recreational property be snapped up by the baby boomers? Not so fast. Last year, a lot of developers tried to offer recreational property in sub-par locations, only to be sent packing by disinterested buyers.

Why do some of these developments sing while others sink? The main difference is still the old adage: location. To be exact, A+ location versus B can make all the difference to your investment outcome. This will present sub-par locations with a huge challenge.

But before you jump out and buy, keep in mind these key components:

1. You have to focus on only A+ property; it’s insulated from downturns and will remain at the top of all lists.

2. Avoid water views when waterfront is available.

3. Make sure there is sufficient infrastructure to support four-season sustainability. Or, at the very least, three seasons.

4. Look for buildings that have a full menu of amenities as they outsell those that don’t.

5. Look at the historic pricing of the area. Based on the statistics, everything in an A+ location is a great buy. But look for the hidden gems that linger behind in price.

6. Avoid areas that have experienced recent spikes in pricing and look for other unknown factors. For instance, do local regulations allow new construction?

Every year, young urban professionals enter the recreational market in search of that dream waterfront property and chase the prices up — but some only end up purchasing in the back row with the rest of the kids from the wrong end of the gene pool whose parents pre-spent their inheritance. Those back row properties can still be fun, but challenge the second fundamental rule of liquidity and appreciation. That means, when extra money gets tight, second-rate second homes are the first asset put up for sale and prices often plummet with oversupply.

So, is the A+ property easy to buy? Think again. Eighty-three per cent of Canadians who own recreational property say they are unlikely to sell within the next three years. Only 15 per cent of owners are even contemplating selling. And of those, 41 per cent — almost half — intend to upgrade into a better recreational property.

Even worse, many of these second homes are regarded by owners as legacy properties that will never be sold outside the family. So that leaves only a tiny percentage of the current recreational product available for purchase.

If you need further proof, compare 50 feet of Kelowna waterfront with a 1,500-square-foot home that is listed today at $2.2 million. Just a few years ago, it was worth $1.4 million. Is it actually worth $800,000 more than it was 30 months ago? Yes, because buyers will pay that price.

Why are areas like Vernon seeing prime waterfront property increases of 25 per cent or more each year? It is the same answer. Value is always set by buyers and, in this case, the buyers don’t care about price. They just want location.

Now, for all those nay-sayers waiting for the crash so they can pick up the prime waterfront locations: Sorry, it’s the back rows and the wounded waterfront that will be available — the stuff that will come back on the market and get hurt when the economy softens — not the ultra high-end A+ product. When the price of the “creating family memories”property goes up, the rich kids just dip a little deeper into the inheritance fund. After all, they didn’t earn this money, so it’s painless to spend.

So far, we have been talking about the recreational real estate market in general in B.C. We also have to account for the strength of the economy in Alberta, where the price of oil has doubled since 2000. Not only are the boomers awash in cash, so is the “average” Albertan who is heading for B.C. and looking for prime real estate.

There is one last factor to consider. Investors and speculators have started to realize that huge profits can be made in recreational real estate. Investors have quickly realized that recreational property is scarce and that buyers are plentiful. Investors are buying multiple homes in new projects, knowing full well that the money is changing hands more and more every day, and that whoever controls the land, controls the profit.

So, what does is all mean? Well, if you already have a superb second home, you are lucky. If you are trying to buy one, don’t wait. Because if you think the price is high now, just wait. I anticipate this headline any day now: “Insatiable recreational property buyers fight over a two-per-cent supply with $41 trillion in buying power.”

See you at the beach.

Bill Morrison has been selling North American residential and recreational properties for more than two decades. He is a principal in Pilothouse Real Estate Marketing.