It’s part of a five-property group up for sale

Bruce Constantineau

Sun

Vancouver’s Westin Bayshore Resort & Marina has been put up for sale in the strongest Canadian hotel market in a decade.

The venerable 511-room property is one of five Canadian Westin-branded hotels listed for sale for a reported collective price of about $750 million. The other hotels are in Calgary, Edmonton, Toronto and Ottawa.

Starwood Hotels & Resorts, which operates the Westin brand, would not confirm the hotels are for sale but Toronto real estate broker CB Richard Ellis has produced a marketing brochure for the properties.

The 47-year-old Westin Bayshore completed a $51-million renovation in 2000, unveiling renovated rooms, a new lobby, the largest hotel ballroom in Vancouver and about 48,000 square feet of meeting space.

A group consisting of Starwood Capital, the Public Sector Pension Investment Board and the Caisse de depot et placement du Quebec acquired the five Westin properties in 2005.

Starwood Canada representative Cynthia Bond said the company won’t comment on market “speculation.”

“But regardless of the hotel ownership, Westin will definitely fly its flag in key Canadian cities as long-term management contracts are in place,” she said.

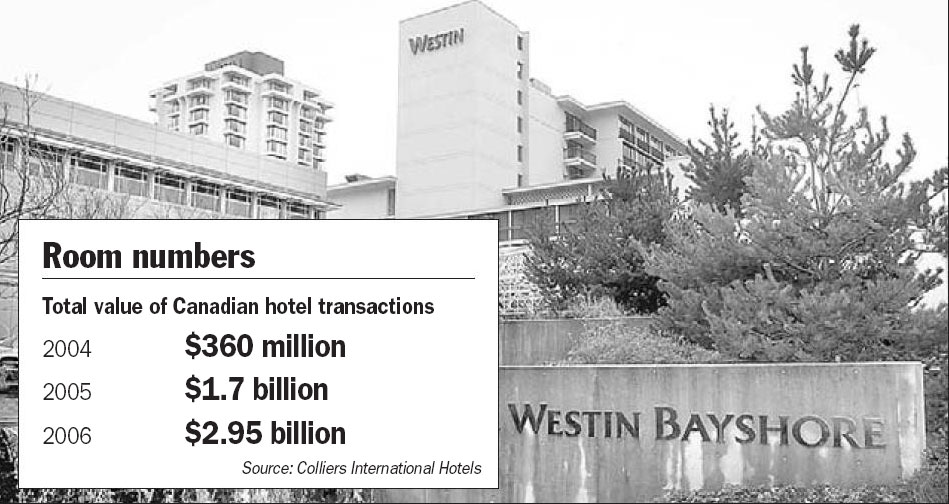

A 2007 Colliers International Hotels report said the demand for Canadian hotel properties “skyrocketed” last year and should continue to soar in 2007.

The report said a rebounding hotel market has attracted several new potential buyers in Canada — including pension funds, private equity firms, hedge funds and hotel real estate investment trusts.

The total value of Canadian hotel sales rose from $1.7 billion in 2005 to $2.95 billion last year, while the total number of transactions increased from 104 to 141. The value of downtown Vancouver hotel properties increased by an estimated 18.2 per cent last year and is forecast to rise by another 20.7 per cent in 2007.

“We’re definitely in for another hot year in transactions,” Colliers International Hotels senior vice-president Tom Andrews said in an interview. “There’s just so much capital in the market and so many new investors, especially in the West.”

He noted while hotel values have soared, the prices are still just 50 to 75 per cent of the cost of building them from scratch in a market like Vancouver, where land and labour costs continue to rise.

He said downtown Vancouver will get about 1,000 new hotel rooms over the next two years but expects they will be easily absorbed into the market as the tourism industry rebounds and the Vancouver convention centre expansion attracts more business. New downtown hotel properties will include the Fairmont Pacific Rim near Canada Place, the Shangri-La near Georgia and Thurlow streets and a Kor Hotel Group property on Melville Street..

Another major Canadian hotel sale could take place this year if the Lalji family of Vancouver proceeds with plans to sell five hotels for $300 million to $400 million. The five-property package includes three Toronto hotels, one Ottawa property and the 440-room Best Western Richmond.

Canadian Hotel Income Properties REIT president Ed Pitoniak said the Vancouver-based 32-hotel chain looks at the current hot market as a “mixed blessing.” He noted CHIP REIT units trade close to an all-time high now and the company generated a total return of 35.5 per cent last year.

© The Vancouver Sun 2007