British Columbia is in the midst of an economic boom.

Derrick Penner

Sun

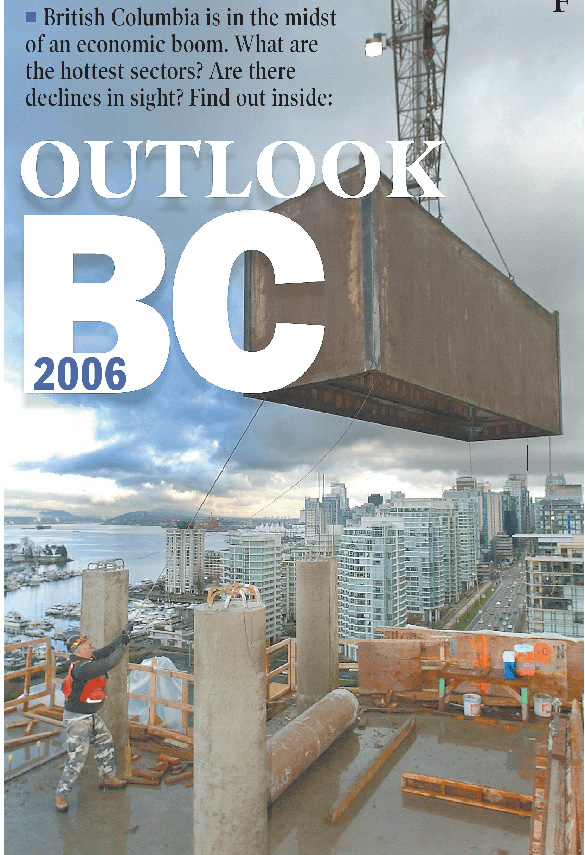

Work is underway on the Laguna project, a 22-storey residential development at Coal Harbour on the edge of Stanley Park. The continuing construction boom has boosted the provincial government’s inventory of current and future major building projects to $83 billion from $68 billion a year ago. Photograph by : Glenn Baglo, Vancouver Sun

Expectations high for 2010 Winter Games

Studies estimate up to 77,000 worker-years of employment will be generated

Expectations are that the Vancouver 2010 Olympics will pump between $5.8 billion and $10 billion worth of new activity into the British Columbia economy by the time the Olympic flame is extinguished in 2010.

RBC Financial Group economist Derek Holt estimates that the Olympics could boost the size of B.C.’s economy by as much as 1.2 percentage points per year, with the economic lift adding up to two-times that amount in 2010.

“This is a significant, positive lift to long-term growth prospects in B.C.,” Holt wrote in a November report.

John Furlong, president of the Vancouver Olympic Organizing Committee, has said that Holt’s forecast would equate to an annual $2.1 billion to $3.3 billion direct and indirect boost to the economy.

“It’s incredible,” Furlong said to the Vancouver Board of Trade. “This is mostly due to construction and labour up to 2009.”

Furlong noted that Vanoc will eventually award more than 10,000 contracts for goods and services. To date, some 300, worth more than $93 million, have been tendered.

Economic impact studies estimate up to 77,000 person years of employment could be generated by the Games with billions of dollars in new construction ranging from $660 million on direct venue spending and billions of dollars on indirect projects ranging from the Sea to Sky Highway upgrade, Canada Line rapid transit line and Vancouver Convention and Exhibition Centre expansion.

Vanoc will contribute some $145.6 million to projects in 2006 including the upgrading of facilities at Cypress Mountain for the Olympics’ freestyle skiing and snowboarding events, construction of a new arena at the University of B.C. and the tenders for athletes villages in Vancouver and Whistler.

Venue costs, however, could escalate substantially before the games take place. The Independent Contractors and Businesses Association of B.C. estimates that construction costs in B.C. could rise 50 per cent by 2010.

Right now, companies beyond big construction firms are beginning to capitalize on the Games in some surprising ways.

Sitka Log Homes in 100 Mile House, for instance, won a $2.9-million contract from the provincial and federal governments to provide a log building for the B.C. Canada Place at the Turin 2006 Olympics in February.

Walter Bramsleven, Sitka’s general manager, said the idea came from the provincial government’s 2010 Olympic and Paralympic Winter Games Secretariat and Ministry of Economic Development “as a way to network the 2006 and 2010 [Winter Olympics] together, but also a great opportunity to promote British Columbia to the European sector of the world.”

While the Turin project isn’t directly part of the Games, Bramsleven is optimistic that his 30-employee firm in B.C.’s interior will receive additional benefits, not only for the 2010 Games but beyond.

“There’s going to be a lot of private-venture developments that are happening and a lot of those will be log and timber buildings, we would expect,” Bramsleven said.

As far as he is concerned, opening the B.C. Canada Place as a venue to showcase B.C. and Canada to the international audience at the Turin Olympics was “absolutely the right thing to do.”

Economic Development Minister Colin Hansen, the minister in charge of B.C.’s Olympics secretariat, said the province is borrowing ideas tried by other Olympic jurisdictions and improving on them to make sure British Columbians wring all the opportunities that they can from the Games.

For example, the B.C. Olympics secretariat created the 2010 Commerce Centre, a spot where all Olympics-related contracts that are put out to tender are posted and can be accessed online.

The provincial government also created the arm’s-length 2010 Legacies Now, a non-profit society aimed at encouraging and helping communities to initiate projects in sports and the arts, linked to the Games, that will have lasting impacts on their health and social wellbeing.

However, Hansen said B.C. has started these initiatives earlier than the governmentsof other Olympic-host jurisdictions, and is doing them better, which has put B.C. “much further ahead than any other Olympic jurisdiction has been four years out [from the Games].”

Hansen said his Olympics Secretariat, through the Commerce Centre, is also trying to encourage the winning bidders on venue construction and other large jobs to do their own purchasing through the centre as well to leverage all the local opportunities they can out of the Games. “The role of the Olympic Secretariat is to strategize and implement programs that will allow us to maximize the ongoing benefits that will result from the Olympic Games,” Hansen said.

Bruce Dewar, chief operating officer of 2010 Legacies Now, added that some 94 communities have set up Spirit of 2010 committees to try and find ways to participate in and benefit from the Games.

Many of the benefits are expected to come in the areas of sports and the arts, but Dewar said some efforts will also have economic benefits.

He noted that through Legacies Now’s “sports hosting” program, some communities, such as Prince George, are lobbying to serve as a pre-Olympics training venue for some of the teams coming to the Games.

That, Dewar said, helps set communities up to market themselves as sports-tourism destinations, which is one of the fastest-growing segments of tourism. So far, he noted, Legacies Now has handed out some $461,000 in grants to communities.

“[Communities] are really opening up their minds about what these Games can bring,” Dewar said.

Hansen added that B.C. didn’t pursue the Games just to host a major sporting event, it pursued them because it is a chance to showcase B.C. to the world.

“[The 2010 Olympics aren’t] an end in themselves, they are a means to an end,” Hansen said. “It’s really [a chance to] catapult B.C. into the next decade and beyond in terms of economic opportunity and spinoffs that will come because of the fact we’re hosting the Olympic Games.”

© The Vancouver Sun 2006

Construction industry ‘so pumped up’

Contractors are scrambling to find sufficient skilled trades workers as the building boom grows

British Columbia is in the midst of a construction boom with some $83 billion in major capital projects listed in the B.C. government’s major projects inventory and contractors scrambling to find skilled tradespeople to do all the work.

In 2005, B.C. also recorded some 31,043 housing starts — the second-highest number on record after 1994, according to statistics from the Canada Mortgage and Housing Corp.

And while CMHC predicts starts will plateau at the 31,000 level in 2006, non-residential construction could continue to rise.

To the end of November 2005, B.C. builders took out residential building permits worth $6.3 billion, up 14.9 per cent from 2004. Non-residential permits for all of 2005, however — for retail stores and offices, schools and hospitals — were up a whopping 25.8 per cent to $3.9 billion.

Philip Hochstein, executive vice-president of the Independent Contractors and Business Association of B.C., said there is always a lag between growth spurts in residential development and non-residential construction. “You don’t build a new shopping centre unless you’ve got new subdivisions,” Hochstein said, and B.C. has built lots of new subdivisions, so shopping centres, schools, hospitals and offices are following.

“In my whole 18 years, 20 years [in the sector], I’ve never seen the construction industry in British Columbia so buoyant, so optimistic, so pumped up,” Hochstein said of 2005.

Hochstein said public sector construction has also picked up as governments try to catch up on what he called an “infrastructure deficit.”

Keith Sashaw, president of the Vancouver Regional Construction Association, said another positive sign is that the construction activity is broadly based within the non-residential field. “What we’re seeing is strength in all sectors,” Sashaw said. “Institutional and government permit volumes [in 2005] were up 138 per cent compared with the same period in 2004.”

Manley McLachlan, president of the B.C. Construction Association, said construction levels are up all over the province. He cited an anecdote from a Prince George-based contractor who was organizing a construction trade show and looking for pieces of heavy equipment that could be used as displays. A year ago, operators made as many as 40 machines available.

“[The organizer] said [this year] he couldn’t find four that weren’t working,” he said.

McLachlan said that in northern B.C., projects include the Prince Rupert port expansion and Enbridge Inc.’s $1.9-billion Gateway pipeline project to pump oil from Alberta’s oil sands to the B.C. coast.

The construction boom has brought big gains in the industry’s employment levels. In December, Statistics Canada’s labour force survey counted some 178,800 construction workers in the workforce, a 14-per-cent increase from a year ago.

But Sashaw said finding skilled workers to build all the proposed projects is an increasing challenge, one that will be with the industry for some time as the workforce ages.

A 2001 industry analysis of the construction workforce found the average age of a qualified tradesperson was 42. Now, he said, the average age in some trades is 48, which means a considerable labour deficit is looming due to retirement.

Hochstein said rising costs and changing bank rates are some of the unpredictable variables that will determine whether the construction boom continues.

“If interest rates go up, the game is over,” Hochstein said. “If construction prices escalate at the rate they’ve been escalating, then projects will become uneconomical.”

The ICBA released research Monday that showed construction costs have gone up 45 per cent since 2000 and could balloon by an additional 55 per cent by the end of the decade.

In the meantime though, Hochstein said 2006 looks like it will be better than 2005, “and 2007 looks pretty good.”

McLachlan said while there are some concerns over labour shortages, no one is complaining about the current general economic conditions.

“It has been a marketplace that people who have been around for awhile haven’t seen in a long, long time,” McLachlan said. “For many people, this is really their first go at working in an economy with this level of activity.”

ECONOMIC IMPACT:

CONSTRUCTION:

2004 EMPLOYMENT 178,800

+14.0%

2005 GDP $7.9 billion

+6.2%*

2006 GDP $8.4 billion

+5.7%**

Source: Statistics Canada, Service Canada, Credit Union Central of B.C.

* 1997 dollars

**Forecast, Credit Union Central B.C.

© The Vancouver Sun 2006

Resources, construction can fuel continued boom

Increased employment likely as industries struggle to keep up with demand for workers to support projected growth

British Columbia started 2006 in the midst of an economic boom the likes of which it hasn’t seen in more than 20 years. And that remarkable growth is likely to continue until the end of the decade, fuelled by strong global demand for the province’s resources and a multi-billion-dollar construction sector expansion.

The economy added 79,700 jobs in 2005, driving the unemployment rate to a 30-year low. The prospects for 2006 are for increasing employment as industries struggle to keep up with demand for workers to support projected growth.

Mining saw a $200-million injection into mineral exploration in 2005, the highest amount in more than a decade as companies scramble to find new resources that can feed Asia’s insatiable demand for copper, zinc, coal and other resources, which are hitting record high prices on world markets.

Mining, fishing, trapping and forestry-support sectors, as well as construction, retail trade and the financial industries are expected to be the fastest-growing sectors of the economy.

The fishing and trapping category, an amalgamation of several small sectors that will add up to just $739 million of the economy in 2006, is predicted to see 10.7-per-cent growth over last year.

Companies also pumped up the provincial government’s inventory of current and future major construction projects to $83 billion from $68 billion a year ago.

Projects contemplated include major infrastructure initiatives, such as Enbridge Inc.’s proposed 1,150-kilometre, $1.9-billion Gateway pipeline to carry oil from the Alberta oilsands across B.C. to Kitimat on the coast.

Billions more in investment are being contemplated to upgrade B.C.’s ports and improve road and rail transportation links in light of the province’s overall strategy to create Canada’s gateway to the booming Asia-Pacific region.

Helmut Pastrick, chief economist for Credit Union Central B.C., expects that the global economy will continue to expand, the United States economy will remain strong, and that investment spending in B.C. will continue to keep up with it all.

Pastrick is projecting that the value of the Canadian dollar, a key factor in the country’s trade performance, will not rise so high against the U.S. currency as to hurt exports, and migration to B.C. will rise faster than to many other provinces, which will help keep “the housing market ticking along.”

“I view that this growth-cycle phase we’re in will extend further and perhaps be more robust than [other economists],” Pastrick said.

Pastrick, in Credit Union Central B.C.’s most recent provincial forecast, estimated that the economy “will be in a faster growth phase” until 2010, and could grow by as much as 20 per cent over the next five years.

That is higher than the previous five years, which saw the economy grow some 15 per cent between 2001 and 2005.

Labour shortages will factor into the forecast, Pastrick added, both on the positive and negative sides. The Credit Union Central’s projection is that the workforce will grow by some three-per-cent per year until 2008, which will help to keep unemployment at record low levels within a workforce that is aging and shrinking.

Pastrick noted that wages have begun to rise in response to tighter labour supplies, which in turn increases the cost to build and make things.

“But [rising wages are] not necessarily a bad thing,” he said. “Higher wages mean higher incomes,” and better incomes, mean more consumer spending power.

The Credit Union Central forecast is for consumer spending to grow by 25 per cent over the next five years accounting for “the bulk of growth in total real [gross domestic product].”

For 2006, Pastrick estimates that growth in consumer spending will translate into some $53 billion in retail sales in B.C. stores.

Canada Mortgage and Housing Corp. also believes that rising wages and continued positive migration numbers will support strong demand for housing. The federal agency is projecting an estimated 31,000 new housing starts across B.C. in 2006 and some 95,000 total real estate sales.

Other economists, however, worry that a constrained labour supply could hold back some of B.C.’s growth.

David Baxter, director of the Urban Futures Institute, a demographics and economic forecasting firm, noted that Alberta’s economy is also “roaring ahead” at the same time as B.C., so it could be difficult to find all the workers it needs to take on all the projects being contemplated.

“When we talk about interprovincial migration, we have to talk about where all those folks are going to come from,” Baxter said.

He added that Alberta, Saskatchewan and Quebec also posted record low unemployment rates in 2005, which will cause those provinces to draw workers to them.

“We look forward in time and say we’re going to have a modest labour supply constraint,” Baxter said.

However, Baxter still predicts that B.C. will see healthy economic growth.

Rising construction costs could also affect B.C.’s ability to grow. The Independent Contractors and Businesses Association of B.C., borrowing the estimate of a major construction quantity surveyor, forecasts that construction costs could rise more than 50 per cent by 2010. That, the ICBA noted, follows a five-year period between 2000 and 2005 where construction costs rose 45 per cent.

Much of the growth will be fuelled by the booming resource sectors, mining and oil and gas exploration.

Experts in the oil and gas sector are predicting that natural gas prices will remain above $9 US per thousand cubic feet, a level that is expected to propel drilling activity in B.C.’s booming northeast to increase by some 20 per cent in 2006.

Miners too are scrambling to keep up with global demand for commodities such as coal and copper. It’s predicted that zinc, gold and silver will all remain hot commodities, which is all good for B.C.

Technology industries are also enjoying a robust recovery from the tech meltdown of 2001.

A recent study conducted by the University of B.C.’s Sauder School of Business for the technology promotion agency Leading Edge B.C. concluded that B.C. tech companies had the best return on investment in North America.

B.C. was a hot spot for technology takeovers in 2005, such as Kodak’s $1-billion takeover of local imaging firm Creo, and PureEdge Solutions by IBM.

Now Leading Edge president George Hunter has noticed that early-stage tech firms are having an easier time finding first-level financing. He said B.C. leads Canada in terms of the amount of money available to new companies, and predicts an unprecedented amount of activity in tech startups.

B.C.’s biotechnology sector is also positioning itself for growth. The provincial government, last September, introduced a tax break for profits earned on life-science-related intellectual property, so long as firms keep the ownership of those patents in B.C.

Karimah Es Sabar, executive director of B.C. Biotech, is characterizing B.C.’s big picture for biotech’s future as good, and is focusing her efforts on building relations between this province and Europe’s burgeoning life-sciences sector.

The province’s film industry is also enjoying a resurgence, also with some tax help from the provincial government.

Here’s what’s going to sizzle:

Fastest-growing sectors in B.C.’s economy for 2006

Mining: $2 billion GDP +13.6%

Fishing, trapping, forestry support: $739 million GDP +10.7%

Construction: $8.4 billion GDP +5.7%

Retail & wholesale trade: $15.7 billion GDP +4.3%

Financial sector: $30.7 billion GDP +4.2%

© The Vancouver Sun 2006